This post is also available in:

![]() 简体中文 (Chinese (Simplified))

简体中文 (Chinese (Simplified))

Guide to Setting Up a Family Office in Singapore

Singapore is well-known as one of Asia’s leading financial business hubs. In fact, Singapore’s reputation has grown not just in Asia but in the world. Investors have flocked to this business epicentre for decades, and they continue to do so, especially to set up a Family Office in Singapore.

What Is a Family Office?

In Singapore, there are around 200 Single Family Offices (SFOs), with the number increasing in recent years. The Singapore Securities and Futures Act does not define the word “single family office,” but according to the Monetary Authority of Singapore (MAS), the term “usually refers to an organisation that manages assets for or on behalf of a family and is also entirely owned or managed by members of that same family.”

In Singapore, there are around 200 Single Family Offices (SFOs), with the number increasing in recent years. The Singapore Securities and Futures Act does not define the word “single family office,” but according to the Monetary Authority of Singapore (MAS), the term “usually refers to an organisation that manages assets for or on behalf of a family and is also entirely owned or managed by members of that same family.”

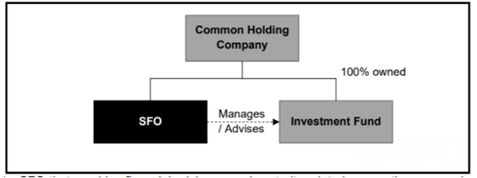

Here is what a typical family office structure might look like:

A single-family office often performs a variety of tasks to aid in the day-to-day administration of a family’s assets. SFOs often hire small teams of trusted advisers and investment specialists, and they also generate indirect jobs in Singapore by engaging external financial, tax, and legal professionals for wealth planning and operating guidance. Tax filing, managing the family’s investments, and consolidating the family’s accounts are all examples of the activities involved. This is a simplified representation of a typical family office ownership structure.

SFOs typically hire financial advisers, investment analysts, legal, and tax specialists to help with wealth planning and operations. SFOs may also be involved in other activities such as account management, tax filing and compliance, managing charities, family governance and lifestyle management, risk management, and wealth and succession planning. Additionally, they also handle managing investments and related finance and administration activities.

Why Choose to Set Up A Family Office in Singapore?

Singapore is a country in Asia unlike any other. There has been an exponential increase in the number of super-rich people and families in the region due to the phenomenal expansion of income and prosperity in the region over the last decade. Don’t be fooled by its small size, because this island nation is one of the strongest business hubs in the world today.

It is also known for its stable government and pro-business climate, and as a result, it has become a favourite choice for many high-net-worth families looking to manage their assets and interests throughout the world. Due to its closeness to local and worldwide private banks, investment banks, and other financial service providers, Singapore is regarded as one of the more notable financial centres in South-East Asia. Asia also has one of the fastest-growing populations of high-net-worth people (“HNWIs”), resulting in a high level of wealth concentration.

Incentives to Establish a Family Office in Singapore

It’s no secret that Singapore is also home to one of the best corporate tax rates in the world. In fact, you might say its tax system is highly competitive. Income that is either sourced in Singapore or remitted to Singapore is subject to a corporation tax rate of 17%.

Singapore also has a broad network of double taxation treaties that can minimise taxation on certain types of income and gains at the source. Singapore does not tax capital gains, and a number of exclusions further restrict the tax base. Foreign dividends that have been subject to some foreign tax and are paid from a jurisdiction with a headline rate of at least 15% are exempt for corporate resident taxpayers. Dividends paid by a Singapore-based corporation are not subject to additional taxes.

To attract even more investors to set up a family office in Singapore, the Government has put a plan in place. The government has developed tax incentive programmes to encourage the formation of these family offices. Almost all investment profits are exempted from Singapore income tax under these programmes for funds managed by family offices.

The exemption is divided into three categories:

- Enhanced-Tier Fund Tax Incentive Scheme (section 13X of ITA)

- Onshore Fund Tax Incentive Scheme (section 13R of ITA)

- Global Investor Program Family Office Option (GIP – FO Principals profile)

Let’s take a closer look at how these incentive schemes work. Under the Singapore Income Tax Act, MAS administers the 13R and 13X schemes (SITA).

- The 13R Scheme was created to make it easier for money to be domiciled in Singapore and to attract capital from non-Singapore investors.

- The 13X Scheme intends to provide Singapore-based funds more options when it comes to sourcing investment mandates. Investments made by Singapore residents are not subject to any limitations or financial penalties under the 13X Scheme.

13R Scheme Key Features

Some of the key features of the 13R scheme include the following:

- The fund resident must be a Singapore Tax Resident

- Singapore based fund manager with a CMS license

- Minimum S$200K business spending in a year for Asset Under Management (AUM)

- MAS approval required

- Cannot be 100% owned by a Singaporean

- No restrictions on fund size

- Annual reporting to investors required

- Annual Tax returns to IRAS required

- Can apply for 1 Employment Pass (EP)

13X Scheme Key Features

Some of the key features of the 13X scheme include the following:

- No restrictions on fund resident

- Singapore based fund manager with a CMS license

- No restrictions on investors

- Minimum S$50Million AUM

- Minimum S$200k Local business spending in a year

- No reporting required

- MAS approval required

- Can apply for 3 Employment Passes (EP)

Singapore’s legal and tax climate makes it a desirable location for establishing an SFO. The 13R and 13X schemes have been designated as part of the MAS’s new Variable Capital Companies (VCCs) programme, This is a flexibly structured company for investment funds that was developed to position Singapore as a regional domiciliation centre.

Benefits of the Tax System for Family Office in Singapore

Regardless of resident or non-resident status, both onshore and offshore family offices in Singapore benefit from tax perks, which include the following:

- The Global Investor Programme (GIP). This is a permanent residence scheme that grants Singapore Permanent Resident (PR) status to eligible global investors with a minimum investment of SGD 2.5 million in a new or existing Singapore-based SFO and an AUM of more than SGD 200 million who commit to a five-year lock-in period. Once a PR status is obtained, SFOs can bring their spouses and children to Singapore on a Dependent Pass.

- The Singapore Resident Fund Scheme, established under Section 13R of the Income Tax Act, exempts income from investments in funds managed by Singapore family offices from taxation if a minimum of SGD 200,000 is spent on worldwide business expenditures each year.

- Under Section 13X of the Income Tax Act, the Enhanced-Tier Fund Tax Exemption Scheme for funds with a minimum SGD 50 million investment, is subject to the involvement of a minimum of three investment professionals and SGD 200,000 in annual business expenditures in Singapore. Applicants who qualify for the 13R and 13X programmes are also given a work permit in Singapore if they provide solutions to an employer. The 13R and 13X funds will get lifetime benefits provided the tax incentive plan is approved before December 31, 2024. Under the 13R and 13X schemes, the Variable Capital Company (VCC) structure can be a lucrative choice for SFOs because an umbrella investment does not require numerous tax filings and VCC shareholders registries are not publicly visible, providing investors with privacy.

Am I Eligible for These Schemes?

The eligibility for the tax incentives under 13R and 13X, on the other hand, is determined on a case-by-case basis. MAS requires a particular amount of information, which includes:

The family office’s activities are as follows:

- The family whose assets will be managed by the office family.

- Names of the family office’s shareholders and directors

- Beneficiaries and the relationship between the family office and the investment fund vehicle

Why You Need Help Setting Up Your Family Office in Singapore

Various administrative obligations may emerge prior to and during the functioning of the family office. There will be a lot of nitty-gritty details to consider that you might not have thought about. Opening bank accounts for the family office, preparing for yearly tax filing, and meeting other regulatory reporting duties, such as the Common Reporting Standards (CRS) and the Foreign Account Tax Compliance Act, are just a few examples (FATCA).

3E Accounting has the associated partners to help you apply for a 13R or 13X tax incentive, as well as assist our customers with any administrative paperwork that may be required.

The Regulatory Requirements You Need to Meet

Although fund management companies must be licensed by MAS, the Securities and Futures Act (Cap 289), when read in conjunction with the Financial Advisers Act (Cap 110), exempts SFOs engaged in fund management and financial advisory activities from licensing requirements. For example, if an SFO is formed as either:

(a) a company that manages money for its associated businesses or

(b) a corporation that offers financial advice services to its related corporations, it may be free from licensing requirements under the statutory exemptions.

In other words, SFOs engaged in such regulated activities will not be required to get a MAS licence. Furthermore, MAS has signalling its openness to consider giving exemptions on a case-by-case basis if an SFO does not fit precisely under the defined limitations.

Want to Set Up A Family Office in Singapore?

Before suggesting a structure that best supports the family office’s immediate and long-term goals, we will explore your requirements and objectives with you. We’ll go over the regulations and essential aspects so you can make an informed decision about the best structure for your needs. The areas we will cover include the following:

- Consultation on the best structure for a family office

- Consultation on regulatory requirements

- Assist with tax planning, migration issues

- Set up of family office corporate companies

- Assist with getting tax benefits and dealing with appropriate government agencies

- Transfer pricing analysis for the family office’s management services

As part of the comprehensive family office structure, we also contribute knowledge in other adjacent industries.