This post is also available in:

![]() 简体中文 (Chinese (Simplified))

简体中文 (Chinese (Simplified))

What is PayNow? and How to Use PayNow in Singapore

What is PayNow? Imagine. You are out with your friends for dinner, and it’s time to pay the bill. The waiter comes with the bill, and everyone is figuring out a way to split the bill. Well, PayNow allows you to split the bill effortlessly without taking out your wallet or make corporate payments. This guide provides information on how to use PayNow in Singapore.

What is PayNow? Imagine. You are out with your friends for dinner, and it’s time to pay the bill. The waiter comes with the bill, and everyone is figuring out a way to split the bill. Well, PayNow allows you to split the bill effortlessly without taking out your wallet or make corporate payments. This guide provides information on how to use PayNow in Singapore.

PayNow is a funds transfer service launched by the Association of Banks in Singapore (ABS) on 10 July 2017. This system allows users of nine banks to transfer cash in SGD to anyone else who has an account with one of these 9 participating banks: Bank of China, Citibank Singapore Limited, DBS Bank/POSB, HSBC, Industrial and Commercial Bank of China Limited, Maybank, OCBC Bank, Standard Chartered Bank, and UOB. All you will need is the mobile number, Singapore NRIC/FIN or UEN of the recipient you are sending a payment to.

Advantages of PayNow

- Send and receive money conveniently

This method eliminates the need to get bank account details. Your recipients’ Mobile Number or Singapore NRIC/FIN or UEN is sufficient - More Secure Funds Transfer

PayNow is built on the same high -security standards as FAST, making transfers not only convenient but safe. - Faster Payout From Government Agencies and Businesses

With PayNow, the power to send and receive money instantaneously is at your fingertips anytime, and anywhere.

How to Register for PayNow

You can sign up for PayNow online through your chosen internet banking account which will then link your bank account to your mobile number and NRIC number for making and receiving payments.

Did you know that PayNow is also extended to businesses, Singapore government agencies, associations and societies? PayNow Corporate will allow these entitle to pay and receive funds by linking their Singapore-issued Unique Entity Number (UEN) to their Singapore bank account.

How To Generate PayNow QR Code with DBS/POSB Digibank?

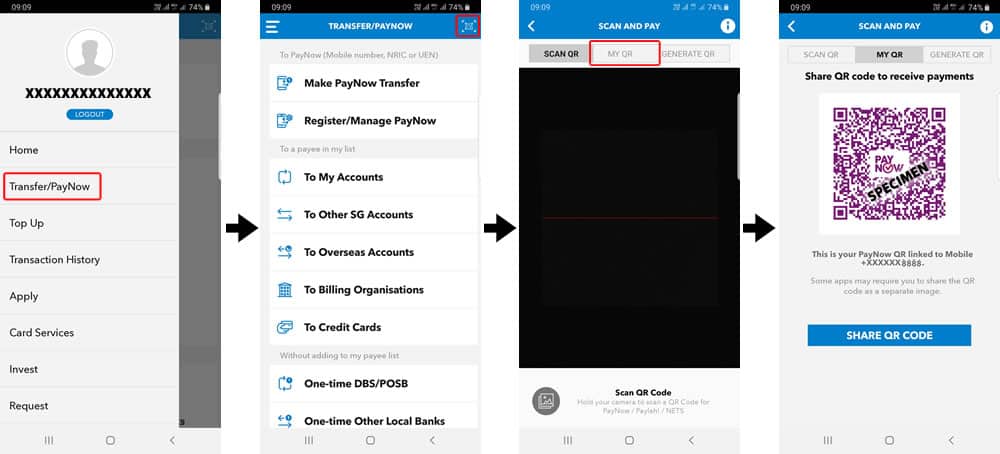

Step 1. Launch your DBS/POSB Digibank Mobile App, login into the app.

Step 2. Click on the menu to slide out from the left and click on “Transfer/PayNow”

Step 3. In the “Transfer/PayNow” page, click on the QR code located at the top right corner to access to “Scan and Pay” page.

Step 4. In the “Scan and Pay” page, click on the “My QR code” tab to locate your own unique registered PayNow QR code.