Singapore’s well-established regulatory and transparent governance system has set the gold standard for business excellence and compliance underpinned by its agency – The Accounting and Corporate Regulatory Authority (ACRA), which regulates business entities, public accountants, and corporate service providers in the state.

Therefore, all the business entities in Singapore shall abide by the laws, rules, and regulations imposed by the ACRA.

ACRA ensures businesses adhere to legal requirements and meet statutory obligations, the compliance failure of which results in hefty penalties, legal consequences, and reputational damage.

This checklist, therefore, provides an overview of the essential ACRA compliance requirements for 2025, ensuring that Companies remain compliant and away from penalties.

ACRA Compliance Checklist 2025

After your Company is duly incorporated and registered with ACRA, and you have taken all the essential post-incorporation steps, you should now meet the regular compliances for the financial year and take care of the circumstantial compliances.

Let’s see what the ACRA’s compliance list of a local Company in Singapore looks like.

Holding an Annual General Meeting (AGM)

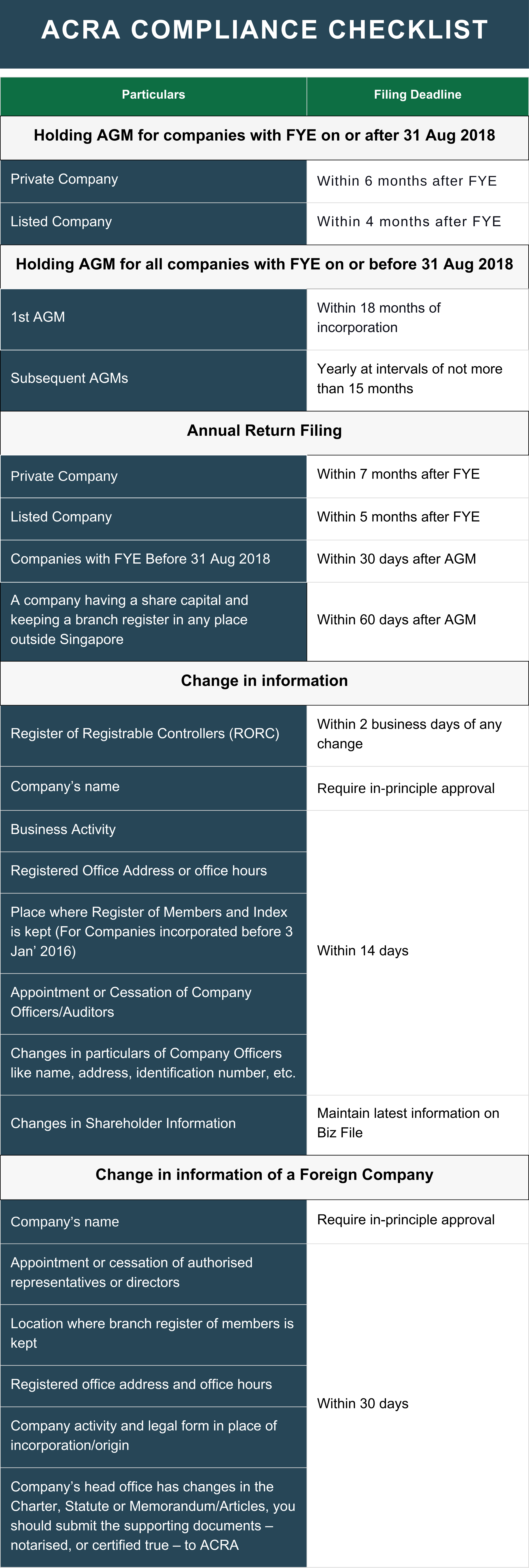

Hold the Company’s AGM within 6 months after the financial year-end (FYE). Hold it within 4 months after the FYE if you have a listed Company.

Exemption: The Singapore Companies Act (Act) exempts private companies from holding AGMs if they send their financial statements to their members within 5 months after the FYE.

However, for Companies having FYE before 31 Aug 2018, the old rules are still applicable, whereby they must hold the Company’s 1st AGM within 18 months of incorporation and subsequent AGMs yearly at intervals of not more than 15 months.

Read our guide Understanding Accounting Period for Singapore Company: What You Need to Know? to know how choosing the correct Accounting Period and FYE impacts statutory compliances.

Filing Annual Return (AR) With ACRA

File the Company’s Annual Return within 7 months after the FYE if you have a Private Company and even if the Company is inactive or Dormant, and within 5 months after the FYE if you have a listed Company.

However, this due date differs for Companies having an FYE before 31st Aug 2018, which shall file the AR within 30 days after its AGM.

The financial statements, being the key reporting documents and filed as part of the Annual Report must be prepared following the Singapore Financial Reporting Standards (SFRS).

Exemption: Companies having a share capital and keeping a branch register outside Singapore, where they have to file within 6 months (listed Companies) or 8 months (non-listed Companies) after the FYE, need not file the Annual Return.

Updating Information Of Companies And Company Officers

Update ACRA of any change in the Company’s information within the stipulated time or apply for in-principal approval wherever required.

For instance, to change the Company’s name, a Company has to take ACRA’s in-principle approval and further update the same via the “Update Entity Information” eServices in Bizfile+ after the name is approved.

Changes in other Company information require updating with ACRA within 14 days of the change and within 30 days in the case of Foreign Companies.

You can always refer to the Compliance Checklist at the end to quickly check on the timelines.

You must keep the latest information on your Company’s shareholders in Bizfile. If you want to add new shareholders, visit Bizfile and submit the “Update shares information” transaction.

Lodging RORC Information With ACRA

Set up the Register of Registrable Controllers (RORCs) containing particulars of Registrable Controllers, commonly known as beneficial owners, within 30 days after the Company incorporation AND file the same information or any change made in RORC with ACRA within 2 business days after the RORC has been set up or updated, as the case may be, via the “Update Register of Registrable Controllers” eService on Bizfile.

Directors Duties In Relation To Financial Reporting

Ensure that the financial statements comply with Singapore Financial Reporting Standards and give a true and fair view of the financial position and performance of the Company. Unless exempted Companies shall submit the duly audited financial statements in XBRL format to ACRA for data accuracy.

Directors must fulfil their fiduciary duties and act in the Company’s best interests. Ensuring timely compliance can prevent legal consequences against the Directors and the Company under the Act and the Financial Reporting Surveillance Programme (FRSP).

Visit ACRA’s official website which provides Companies and Directors with help resources to carry out their financial reporting duties.

Other Compliances

- Apart from the above specific compliances, Companies must take care of the following:

- Keeping updated registers of Shareholders, Directors, Secretaries, and Charges.

- Document all board resolutions, minutes of the meetings and maintain proper records.

- Directors must disclose any conflicts of interest.

- Submit Corporate Income Tax returns annually to the Inland Revenue Authority of Singapore (IRAS).

- File periodic GST returns, if applicable.

- Maintain written employment contracts in line with the Employment Act.

- Contribute to the Central Provident Fund (CPF) for eligible employees.

- Ensure valid employment passes for foreign employees.

- Acquire necessary business licenses based on the industry, such as F&B, retail, finance, etc.

- Renew all business licenses periodically to avoid penalties.

- Adhere to the Personal Data Protection Act (PDPA) by securing personal data and ensuring proper data usage.

- Maintain proper accounting records.

- Keep a track on ACRA updates, changes in the Act, and the applicable laws to stay compliant all the time.

Conclusion

Staying compliant with ACRA’s regulatory requirements is essential for any business operating in Singapore. This checklist serves as a guide to help businesses simplify the complex regulatory environment and avoid any non-compliance pitfalls.

However, some might find the list too long and complex to comply with. Partnering with 3E Accounting Services you can ensure that all compliance requirements are met efficiently enabling you to focus on your business growth and expansion.

ACRA Compliance Checklist

Note: The above list provides a general overview of key compliance requirements with ACRA for Singapore companies. It is not an exhaustive list of all statutory obligations. Companies should review their specific circumstances and consult relevant professionals to ensure full compliance with all applicable regulations.

Disclaimer: This blog is for informational purposes only and does not constitute any legal advice.

Download Your 2025 ACRA Compliance Checklist Now!

Stay Compliant, Stay Ahead WIth 3E Accounting Services 🎯

Frequently Asked Questions

The Accounting and Corporate Regulatory Authority, commonly known as ACRA is Singapore’s national regulator of business registration, financial reporting, public accountants, and corporate service providers, ensuring that all businesses in the country comply with regulatory requirements. Non-compliance can result in penalties and legal repercussions.

Listed Companies must file the Annual Return with ACRA within 5 months of the Financial Year End. All other Companies including inactive or Dormant Companies must file within 7 months after the Financial Year End.

The deadline for holding AGM is linked to 31st Aug 2018, the effective date for new rules. The Private and Listed Companies having FYE after 31st Aug 2018 shall hold the AGM within 6 months and 4 months respectively, after the FYE.

Companies having FYE before 31 Aug 2018, the old rules are still applicable, whereby they must hold the Company’s 1st AGM within 18 months of incorporation and subsequent AGMs yearly at intervals of not more than 15 months.

Most of the changes in Company information require updating with ACRA within 14 days of the change and within 30 days in the case of Foreign Companies. However to change Company’s name one needs an in-principle approval of ACRA. Refer to our ACRA Compliance checklist to know the deadlines of specific changes.

If you want to add new shareholders, visit Bizfile and submit the “Update shares information” transaction. You must keep the latest information on your Company’s shareholders in Bizfile.

Late filings may incur penalties, summonses, or even company strike-offs for prolonged non-compliance.

Regularly check ACRA’s official website or engage a corporate service provider to stay informed about regulatory updates.

Abigail Yu

Author

Abigail Yu oversees executive leadership at 3E Accounting Group, leading operations, IT solutions, public relations, and digital marketing to drive business success. She holds an honors degree in Communication and New Media from the National University of Singapore and is highly skilled in crisis management, financial communication, and corporate communications.