Selecting the right business structure is the foundational step in incorporating your business in Singapore. The kind of business structure you choose will have a direct impact on critical aspects of your business such as taxes, personal liability, administrative responsibilities, and the ability to raise capital. A poorly aligned choice can not only limit your business’s potential but also create unnecessary risks and challenges that could hinder growth and long-term success.

To ensure your business thrives, it’s crucial to understand the nuances of each structure and how they align with your specific goals. In this guide, we’ll break down the options available to help you make the most informed decision. Let’s get started!

Types of Business Structures

When incorporating a business in Singapore, there are four primary business structures to consider:

- Sole Proprietorship (for a single owner) or Partnership (for two or more owners)

- Limited Partnership (LP)

- Limited Liability Partnership (LLP)

- Company

Each of these structures comes with its own set of legal, financial, and operational implications, making it essential to choose the one that best aligns with your business goals and needs. Let’s explore the key characteristics, pros, and cons of each business structure to help you make an informed choice that best suits your business goals.

1. Sole Proprietorship

A Sole Proprietorship is the simplest business structure and is suitable for individual entrepreneurs who want full control. However, this simplicity comes at a cost—unlimited liability. The owner is personally responsible for all debts and obligations.

Key Features of Sole Proprietorship:

- A Singapore citizen, permanent resident, or EntrePass holder aged 18 years or above is eligible to form a Sole Proprietorship.

- Not a separate legal entity.

- Income is taxed at personal income tax rates (0%-22%).

- Unlimited liability for business debts.

- Difficult to raise funds for expansion.

Benefits of Sole Proprietorship:

- Easiest to set up, manage, and close.

- Cost-effective to set up, with a one-time registration fee of $115.

- Only need to renew registration once a year or 3 years, with subsequent renewals at $30 per year.

Disadvantages of Sole Proprietorship:

- Unlimited liability for all debts and obligations of the Business.

- May be more difficult to secure loans and funding from banks and investors.

- Taxed at personal income tax rates, with no corporate tax reliefs available.

- Limited options for business grants, and not eligible for Startup SG grants.

- Business will cease upon the owner’s demise.

2. Partnership

A Partnership is formed by two or more individuals or entities who come together to operate a business. There are three types of partnerships in Singapore:

2.1 General Partnership

Similar to a sole proprietorship, a general partnership exposes all partners to unlimited liability. Key features, Advantages and disadvantages are similar to a sole proprietorship entity.

2.2 Limited Partnership

In a Limited Partnership, there are general and limited partners. The limited partners’ liability is restricted to their capital contribution.

Key Features of Limited Partnership:

- At least one general and one limited partner.

- Limited partners have liability protection.

Advantages of Limited Partnership:

- Easy to set up, manage, and close.

- Cost-effective to set up, with a one-time registration fee of $115.

- Only need to renew registration once a year or 3 years, with subsequent renewals at $30 per year.

- Limited Partners have capped liability, limited to their agreed investment in the LP.

Disadvantages of Limited Partnership:

- General Partners bear unlimited liability for all debts and obligations of the LP.

- May be more difficult to secure loans and funding from banks and investors.

- Taxed at personal income tax rates, with no corporate tax reliefs available.

- Limited options for business grants, and not eligible for Startup SG grants.

- LP will be suspended if there is no Limited Partner registered with ACRA.

2.3 Limited Liability Partnership (LLP)

An Limited Liability Partnership (LLP) combines the flexibility of a partnership with the liability protection of a company. It is often chosen by professionals like accountants, lawyers, and architects.

Key Features of Limited Liability Partnership (LLP):

- Separate legal entity.

- Partners are liable for their own misconduct but not for the actions of other partners.

- Personal income tax rates apply.

Advantages of Limited Liability Partnership (LLP):

- Hybrid structure that provides the flexibility of a Partnership while maintaining a separate legal identity like a Company.

- Cost-effective to set up, with a one-time registration fee of $115.

- Only need to file an annual declaration as part of statutory filing obligations.

- Limited Partners are not personally liable for any business debts incurred by the LLP.

- Any change in partners will not affect the LLP’s existence, rights, or liabilities.

Disadvantages of Limited Liability Partnership (LLP):

- Limited Partners may be personally liable for claims from losses resulting from their own wrongful acts or omissions.

- Taxed at personal income tax rates, with no corporate tax reliefs available.

- Limited options for business grants, and not eligible for Startup SG grants.

- Requires a formal process to wind up or strike off the LLP.

- Difficult to transfer ownership of LLP.

3. Limited Liability Company (LLC)

An Limited Liability Company (LLC) limits the personal liability of its shareholders to the capital invested in the business. There are three main types of LLCs in Singapore:

3.1 Private Limited Company (Pte Ltd)

This is the most preferred business structure in Singapore due to its flexibility, liability protection, and tax benefits.

Key Features:

- Separate legal entity.

- Limited liability for shareholders.

- Taxed at a corporate rate (up to 17%).

- Transfer of shares is easy.

- 100% foreign ownership is allowed.

Advantages of incorporating a Company:

- Offers the most advanced and flexible business structure, providing more credibility than other structures.

- Exists as a separate legal entity, protecting personal assets of its members.

- Eligible for corporate tax exemptions and easy to raise capital.

- Fulfills part of the eligibility criteria for business grants and Start-up SG grants.

- Ownership can be transferred easily through the sale or purchase of company shares.

Disadvantages of incorporating a Company:

- Most costly to set up, with more administrative procedures required.

- Stricter compliance requirements to meet, including Annual General Meetings, financial statements, audits, and corporate tax filing.

- Requires a formal process to wind up or strike off the company.

3.2 Public Limited Company

A Public Limited Company can issue shares to the general public and is listed on the stock exchange. It is typically chosen by larger corporations.

Key Features:

- More than 50 shareholders.

- Can raise capital through public offerings.

- Subject to stringent compliance and regulatory requirements.

Advantages and Disadvantages of incorporating a Company remain the same as above.

3.3 Public Company Limited by Guarantee

Typically used by non-profit organizations, this structure is designed for entities focused on promoting charitable, educational, or social causes.

Key Features:

- No share capital; members contribute a fixed amount if the company is wound up.

- Used for non-profit organizations, professional bodies, and clubs.

Advantages and Disadvantages of incorporating a Company remain the same as above.

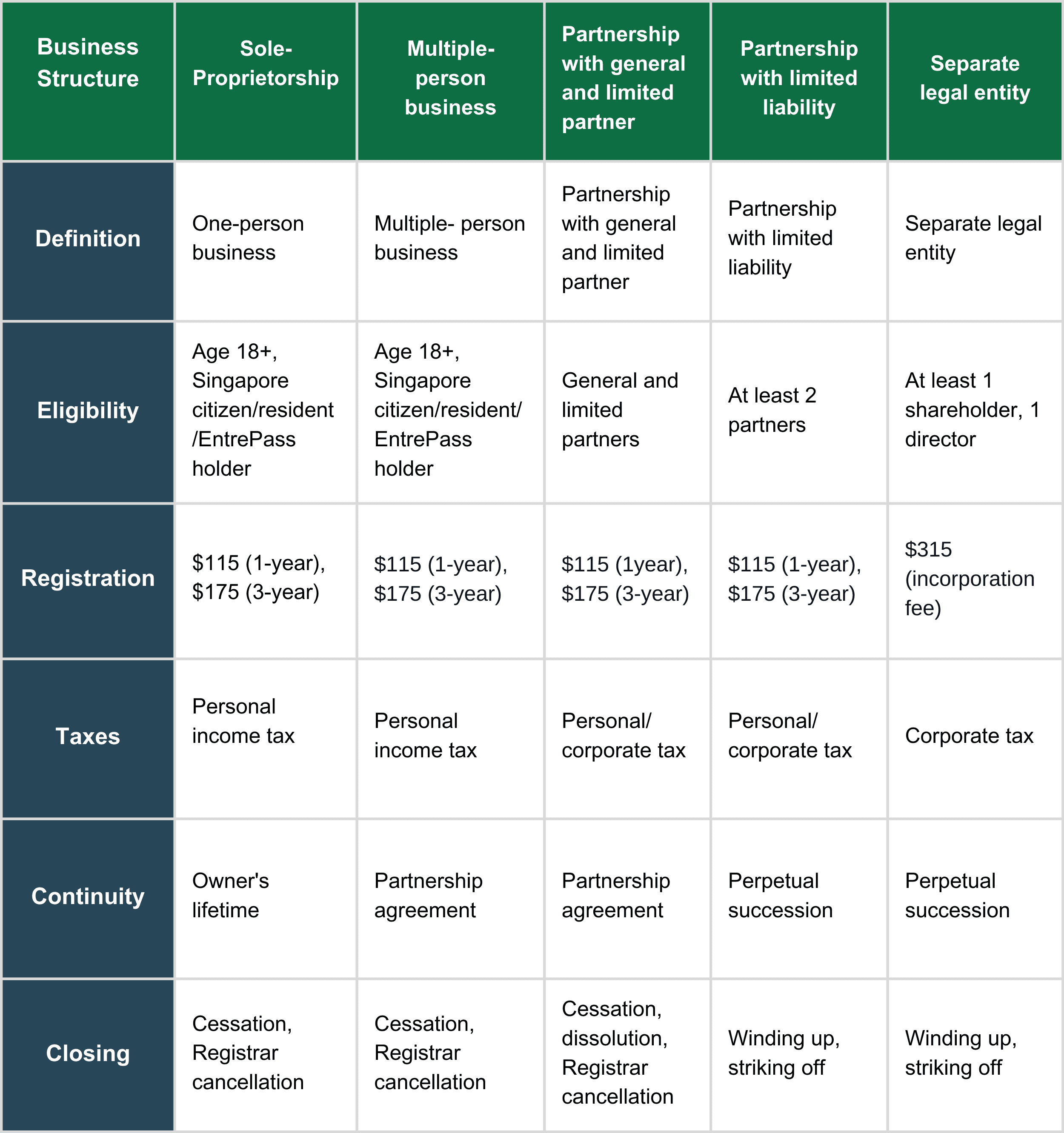

Comparative Analysis of Business Structures

Below is a snapshot of comparison among various business structures :

Business Structures for Foreign Company Incorporation

Foreign companies wishing to expand into Singapore can choose from the following structures:

Subsidiary Company

A Subsidiary Company is an LLC with the foreign company acting as the major shareholder. It is considered a local company, allowing it to benefit from Singapore’s tax incentives.

Key Features:

- Separate legal entity from the parent company.

- 100% foreign ownership allowed.

- Access to local tax benefits.

Branch Office

A Branch Office is an extension of the foreign parent company and is not considered a separate legal entity. This means the parent company is liable for all debts incurred by the branch.

Key Features:

- Not a separate legal entity.

- Liable for the debts of the branch.

Representative Office

A Representative Office allows foreign companies to conduct market research or explore opportunities without engaging in commercial activities. It is not considered a legal entity.

Key Features:

- No legal status.

- Cannot engage in commercial activities.

- Temporary arrangement for market exploration.

Conclusion

Incorporating a business in Singapore can be a complex process, with various business structures to consider. Each structure has its own set of advantages and disadvantages, and choosing the right one is crucial for the success of your business.

In this blog post, we have explored the key characteristics, pros, and cons of the four primary business structures in Singapore: Sole Proprietorship, Partnership, Limited Partnership, and Company.

For foreign companies looking to expand into Singapore, there are also several business structure options available, including Subsidiary Company, Branch Office, and Representative Office.

By understanding the different business structures available in Singapore, you can make an informed decision that best suits your business goals and needs.

For expert guidance on company incorporation and registration in Singapore.

Contact 3E Accounting today to ensure a smooth and efficient setup.

Incorporate Company in Singapore

Let our experts advise you on choosing the best business structure and seamless company incorporation.

Contact Us TodayFrequently Asked Questions

To establish a Pte Ltd company in Singapore, you must fulfill the following prerequisites:

- Ensure you have at least one shareholder

- Meet the minimum capital requirement

- Appoint a local resident director

- Appoint a company secretary

- Register a local office address

There are several reasons why private limited companies are a popular choice for businesses:

- Limited liability protection: A private limited company has its own separate identity, which protects the personal assets of its shareholders and directors.

- Tax advantages: Private limited companies enjoy a low corporate tax rate and do not pay dividend tax, making it an attractive option for businesses.

- Easy capital raising: Private limited companies can raise capital by issuing additional shares, making it easier to expand the business.

- Transfer of ownership: Ownership can be transferred easily through the sale of shares, ensuring the business can continue to thrive even if a shareholder leaves or passes away.

- Credibility: Setting up a private limited company demonstrates a commitment to running a serious and scalable business, which can enhance credibility with stakeholders.

To set up a private limited company in Singapore, you must meet the following requirements:

- Local director: You must have at least one director who is a Singapore resident.

- Company secretary: You must appoint a company secretary who is responsible for ensuring the company complies with regulatory requirements.

- Shareholder: You must have at least one shareholder who can be an individual or a company.

- Paid-up capital: You must have a minimum paid-up capital of S$1.

- Local registered address: You must have a registered business address in Singapore.

Abigail Yu

Author

Abigail Yu oversees executive leadership at 3E Accounting Group, leading operations, IT solutions, public relations, and digital marketing to drive business success. She holds an honors degree in Communication and New Media from the National University of Singapore and is highly skilled in crisis management, financial communication, and corporate communications.