Despite being a highly regulated economy, Singapore is a pro-business hub where the government supports entrepreneurs at every step. From company registration in Singapore, business incorporation, and Singapore company registration to offering legal and financial guidance, Singapore provides a strong foundation. Its strategic location and laws give businesses access to emerging markets across Asia. With a low-tax system and robust intellectual property protection, Singapore remains a preferred destination for foreign entrepreneurs looking to expand and grow their businesses in Asia.

Why Register a Business in Singapore?

Singapore’s global reputation as a hub for business and innovation makes it an ideal location for foreign entrepreneurs. Here are some compelling reasons why you should consider registering your business in Singapore:

- Strategic Geographical Location: Positioned in the heart of Asia, Singapore offers easy access to key markets, including China, India, and Southeast Asia.

- Favourable Tax Regime: Singapore’s corporate tax rates are among the lowest in the world, with various tax incentives and exemptions available.

- Intellectual Property Protection: Strong IP laws safeguard your trademarks and innovations.

- Comprehensive Trade Agreements: With over 100 trade agreements globally, Singapore provides seamless access to international markets.

- Political Stability: Singapore is known for its transparent governance and strong regulatory environment, making it a safe place for long-term investments.

Selecting the Best Business Structure for Foreign Entrepreneurs

When incorporating a company in Singapore, selecting a business structure that aligns with your goals and operational needs is essential. The Accounting and Corporate Regulatory Authority (ACRA) regulates business registration and provides several structures tailored for foreign entrepreneurs. Below are four options:

Transfer of Registration

Foreign businesses can open a company in Singapore through re-domiciliation, effectively converting the foreign entity into a Singapore-registered company. This option allows businesses to operate under Singapore’s legal framework.

Representative Office (RO)

A Representative Office (RO) enables foreign companies to explore business opportunities in Singapore without engaging in commercial operations or profit-generating activities. It’s a temporary structure ideal for assessing the market before fully committing.

Subsidiary/Local Company

Foreign businesses can establish a subsidiary, a locally incorporated company fully owned by the foreign parent company. The subsidiary operates as a separate legal entity and must comply with Singapore’s statutory regulations, but it offers the benefit of full ownership.

Branch Office

A branch office allows foreign companies to open a business in Singapore, but unlike a subsidiary, it is not a separate legal entity. The foreign parent company is liable for the branch’s operations, and the branch must appoint a locally resident and authorised representative.

Requirements for Local Residency

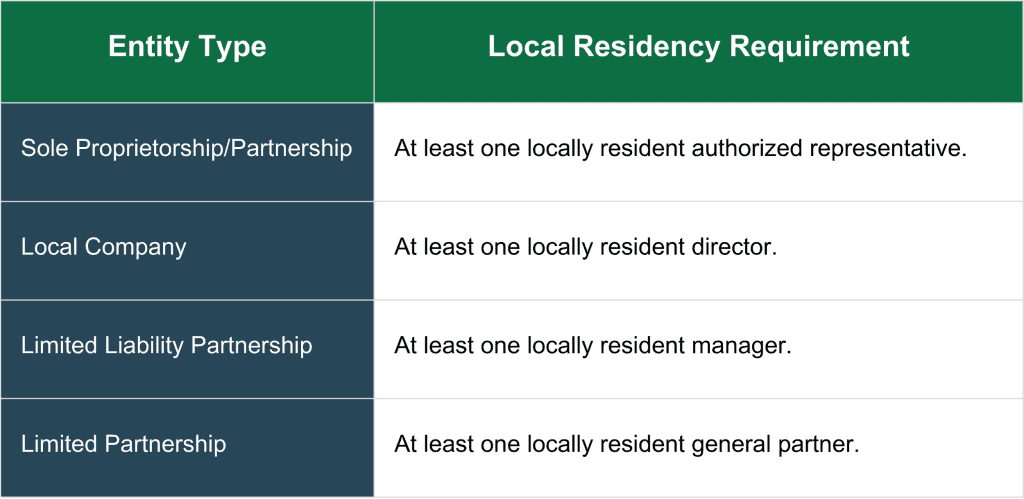

One of the critical requirements for incorporating a business in Singapore as a foreigner is the need to have at least one locally resident individual involved in the management or representation of the company. This is mandated by the Accounting and Corporate Regulatory Authority (ACRA) to ensure local accountability and compliance with Singapore’s corporate regulations.

Below is a detailed explanation of the local residency requirements based on different business entities:

1. Sole Proprietorship/Partnership

You must appoint at least one locally resident authorised representative to establish a sole proprietorship or partnership if you are a foreigner. This individual will be responsible for managing the business operations in Singapore and ensuring compliance with legal obligations.

For foreigners residing overseas, having a locally resident-authorised representative, such as a Singapore Citizen, Permanent Resident, or an Employment Pass (EP) holder, is mandatory. If you plan to relocate to Singapore to manage the business yourself, you will need approval from the Ministry of Manpower (MOM) to live and work in Singapore.

2. Local Company (Private Limited Company)

Foreigners establishing a private limited company (a local company) in Singapore must appoint at least one resident director. This director must be a Singapore Citizen, Permanent Resident, or an individual holding a valid pass such as an EntrePass, Employment Pass (EP), or Dependant’s Pass (DP) with a Letter of Consent.

It’s important to note that while foreigners can own 100% of the company’s shares and even be appointed as foreign directors, the requirement for a local director ensures that there is an individual within Singapore who can be held accountable for the company’s legal and regulatory obligations.

3. Limited Liability Partnership (LLP)

The same local residency requirement applies to foreign entrepreneurs opting for a Limited Liability Partnership (LLP). At least one resident manager must be appointed to oversee the operations of the LLP in Singapore. Like other business structures, this local manager can be a Singapore Citizen, Permanent Resident, or a valid pass holder (EntrePass or EP).

Foreign partners who wish to be physically present in Singapore to manage the LLP must obtain the necessary work passes from the Ministry of Manpower (MOM) after registering the business.

4. Limited Partnership (LP)

A Limited Partnership (LP) requires at least one resident general partner or a local manager to ensure compliance with Singapore’s regulatory framework. The general partner holds personal liability for the partnership’s operations. If the foreign partner intends to manage the LP’s operations actively, they will need MOM’s approval to live and work in Singapore.

As in other business structures, the local partner or manager must be a Singapore Citizen, Permanent Resident, or someone holding a valid Employment Pass or EntrePass.

5. Branch Office of a Foreign Company

Foreign companies registering a branch office in Singapore must appoint at least one local representative. This representative will ensure that the branch complies with local laws and regulations. The appointed individual must either be a Singapore Citizen, Permanent Resident, or an Employment Pass holder with valid residency in Singapore.

Who Qualifies as a Locally Resident Representative?

For all business structures, the locally resident individual must be one of the following:

- A Singapore Citizen or Singapore Permanent Resident.

- A holder of an EntrePass, Employment Pass, or Dependant’s Pass with a Letter of Consent issued by MOM.

In all cases, this individual is responsible for managing the company or business and must meet all statutory requirements in Singapore.

Foreign Identification Number (FIN) Holders

Foreigners holding a Foreign Identification Number (FIN) should confirm their eligibility to register a business in Singapore or take on roles such as director or secretary by consulting the relevant pass-issuing authorities, such as the Ministry of Manpower (MOM) or the Immigration & Checkpoints Authority (ICA). Not all pass holders can serve in such positions without additional approval.

Engaging a Nominee Director

A common practice for foreign entrepreneurs who do not meet the local residency requirements is appointing a nominee director. This resident individual serves as the director to fulfil ACRA’s requirements. While the nominee director takes on the legal obligations of the role, the foreign business owner remains in full control of the company’s operations and decision-making. This solution allows foreign business owners to comply with local laws without needing to relocate to Singapore. However, the nominee director may charge a fee for their services and should be carefully selected to ensure trust and reliability.

Here are the local residency requirements based on the type of business entity in a snapshot:

Foreigners Operating a Business in Singapore

Foreigners in Singapore who want to start a business must navigate specific legal requirements. Depending on their residency status, different passes or permits may be necessary.

EntrePass

Foreign entrepreneurs with innovative business ideas may apply for the EntrePass from the Ministry of Manpower (MOM). This pass allows eligible individuals to operate their businesses while residing in Singapore. Applications can be submitted before or within six months of incorporating a company with ACRA.

Dependant’s Pass (DP)

Dependants of Employment Pass holders can apply for a Letter of Consent (LOC) to incorporate a company. DP holders must register their business with ACRA before applying for the LOC.

Foreign Identification Number (FIN) Holders

Foreigners with FINs need to consult with MOM or the Immigration & Checkpoints Authority (ICA) to confirm their eligibility to incorporate and manage the company in Singapore.

Engaging a Registered Filing Agent

Foreign entrepreneurs without EntrePass must appoint a registered filing agent (such as a law firm, accounting firm, or corporate secretarial firm) to file their company registration on BizFile+—ACRA’s online business registration portal. These agents can also assist with other compliance-related services, such as:

- Provision of a Company Secretary

- Filing of annual returns with ACRA

- Maintaining statutory records

Engaging a professional filing agent is essential for ensuring compliance with Singapore’s corporate regulations.

Conclusion

Company registration in Singapore as a foreigner may seem complex, but the process can be streamlined with the right guidance and understanding of the legal requirements. Singapore’s pro-business environment, low tax rates, and strategic location make it an excellent choice for foreign entrepreneurs. Foreign business owners can successfully navigate the Singaporean market by choosing the right business structure, complying with residency requirements, and leveraging professional filing agents.

If you are considering registration of a company in Singapore, 3E Accounting can help you with Fast company incorporation, filing requirements, and ongoing compliance. Contact us today to discover how we can support you on this exciting business journey.

Looking to Incorporate in Singapore?

Let 3E Accounting simplify the process with expert guidance and seamless

Contact Us TodayFrequently Asked Questions

Yes, foreigners can own 100% of the equity in a Singapore company. Individuals and companies, whether local or foreign, over the age of 18 can easily register a company in Singapore. By law, companies are considered separate legal entities with rights similar to those of individuals, allowing foreign companies or individuals to fully own shares in a Singapore company.

A foreigner can incorporate a company in Singapore without the need to relocate. However, they are required to appoint a local director at the time of incorporation. Once the local director is appointed, the foreign business owner can manage the company remotely from their home country.

If a foreigner wishes to act as the local resident director of their Singapore company, they must first acquire an appropriate work pass, such as an Employment Pass or an EntrePass, before they can relocate and legally work in Singapore. Without a valid work pass or visa, they are not allowed to undertake directorial duties within the country.

To register a Singapore company as a foreigner, you must meet certain legal requirements. Firstly, while you can own the company as a shareholder, you’ll need to appoint at least one locally resident director. This can be yourself (if you acquire the necessary work pass) or someone over 18, such as a friend or family member, who will act in the company’s best interest.

The locally resident director will handle important tasks like ensuring the company meets its statutory obligations, calling the Annual General Meeting (AGM), filing annual returns, maintaining statutory registers, and managing corporate governance.

The key requirements for registering a company in Singapore include:

- Minimum paid-up capital of S$1

- At least one shareholder (up to a maximum of 50)

- At least one locally resident director

- A company secretary (to be appointed within six months of incorporation)

- A registered local address for the business

Meeting these requirements ensures compliance with Singapore’s corporate regulations, enabling smooth operations.

When operating in Singapore, it is crucial to comply with the requirements of several key regulatory authorities:

- ACRA (Accounting and Corporate Regulatory Authority): Ensures your business adheres to company registration and compliance regulations.

- MOM (Ministry of Manpower): Governs employment practices, work passes, and workforce management.

- IRAS (Inland Revenue Authority of Singapore): Handles tax matters, including corporate tax filing and compliance. Businesses must follow all legal obligations set by these authorities to avoid penalties or disruptions.

Abigail Yu

Author

Abigail Yu oversees executive leadership at 3E Accounting Group, leading operations, IT solutions, public relations, and digital marketing to drive business success. She holds an honors degree in Communication and New Media from the National University of Singapore and is highly skilled in crisis management, financial communication, and corporate communications.